Sale & Leaseback: Unlocking Liquidity for Real Estate Owners.

In a sale-and-leaseback transaction, a property owner sells a building and then leases it back, gaining liquidity while maintaining operations. Let us be your discreet partner, ensuring a fair pricing model and lease agreement that benefits both parties.

Sale & Leaseback – hand in hand together with our Clients.

Collaborative Partnership between Tenant and Landlord

-

From old to new: The Tenant and Landlord relationship

For a successful Sale and Lease Back transaction, it's crucial to work together as equals. Our client, as the buyer and future landlord, plans the next steps jointly with the selling company. We ensure the seller's future plans and needs are reflected in the contract, providing security and involvement in decisions. Our approach, "built to suit," means we consider tenants' ideas when building or renovating properties.

Flexible Use with Multi-Tenant Solutions

-

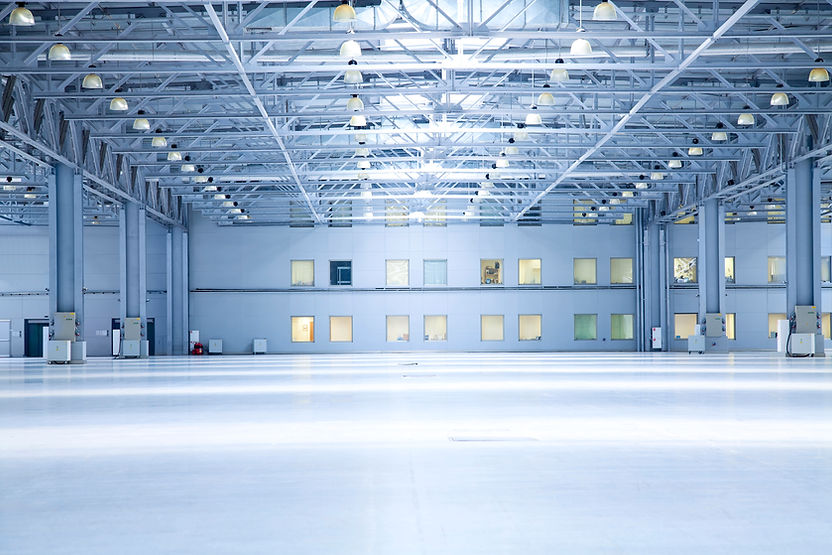

As the new owner, Qore and its partners can modernize and repurpose available spaces for the broader real estate market. By transforming former single-tenant properties into multi-tenant spaces, we boost economic activity and reduce the risk of income loss from tenant vacancies.

Experienced Sale & Leaseback Management serving Asset Owners to sell, and lease back their Property.

Why Consider a Sale & Leaseback Transaction?

-

Creating Equity: In today’s market, real estate values are often soaring. The market value of your property could be significantly higher than its book value. This difference represents hidden reserves, which can be converted into balance sheet equity, giving your business the financial strength it needs to thrive.

-

Releasing Liquidity: Your business's capital shouldn't be tied up in bricks and mortar. By freeing up these funds, you can reinvest them into your operations or fuel the next stage of your company’s growth.

-

Adjusting Capital Structure: A Sale & Leaseback transaction offers a unique opportunity to optimize your capital structure. Whether it's reducing debt, repaying capital, or distributing dividends to owners, you gain the flexibility to manage your financial obligations more effectively.

-

Enhancing Operational Flexibility: With a Sale & Leaseback, you aren’t locked into a long-term commitment. At the end of the minimum lease term, you have the opportunity to re-evaluate your location, providing a strategic exit strategy that can lead to a win-win scenario.

Read our article

Unlocking Capital Through Sale & Leaseback: A Strategic Solution for Mid-Sized Companies In today’s rapidly evolving business landscape, many mid-sized companies are seeking innovative ways to unlock liquidity and stabilize their finances. One strategy gaining traction is the sale and leaseback model—a financial tool that allows businesses to sell their owned properties and lease them back under long-term agreements. To shed light on the benefits and intricacies of this approach, we spoke with key experts at Qore Real Estate, a firm specializing in client-focused real estate solutions. Q: What makes the Sale & Leaseback model appealing to mid-sized companies? Marcel Arzner, Senior Advisor at Qore Real Estate: The appeal lies in the ability to quickly unlock tied-up capital. For mid-sized companies, liquidity is essential for various reasons—whether it’s for new product development, expanding into new markets, or managing through a crisis. The sale and leaseback model offers an efficient way to convert real estate assets into cash, which can then be reinvested into the business. Importantly, the company retains operational control over the property through a lease agreement, allowing them to continue business as usual. Q: What should companies consider before opting for Sale & Leaseback? Oliver Spring, Founder and CEO of Qore Real Estate: Several factors need to align for a successful sale and leaseback transaction. First, the property should have strong market appeal, meaning it should be easily rentable to other tenants if needed. Location, condition, and the overall market demand for such properties are crucial. Additionally, the company’s goals and challenges must be clearly defined—whether they’re seeking to address immediate liquidity needs or planning a significant investment in their core operations. Q: How does Qore tailor its approach to meet client needs? Marcel Arzner: At Qore, we pride ourselves on a client-centric approach. We understand that each company has unique circumstances, so we work closely with our clients to develop a customized strategy. This includes fair pricing and transparent lease agreements that align with their long-term objectives. Our goal is to ensure that the transaction benefits our clients without compromising their operational stability. Q: Can Sale & Leaseback be particularly beneficial during economic downturns? Oliver Spring: Absolutely. During times of economic uncertainty, having access to liquid capital is crucial. A sale and leaseback transaction can provide the necessary funds to manage through tough periods, whether it’s to maintain payroll, invest in new technology, or stabilize operations. Additionally, the flexibility of such agreements allows companies to react quickly to changing market conditions, which is especially valuable during downturns. Q: What are the key advantages for investors in Sale & Leaseback deals? Oliver Spring: For investors, the main advantage is a stable, long-term cash flow with reduced risk. When the tenant is also the seller, they have a vested interest in maintaining the property’s condition, as they continue to operate from the same location. This often results in lower maintenance costs and a reduced risk of vacancy. The investor benefits from a reliable income stream, while the company secures the capital it needs without disrupting its operations. Q: How is the current market for Sale & Leaseback transactions? Marcel Arzner: Investor interest in sale and leaseback deals has surged in recent years, and this trend continues today. The appeal for investors is clear—they gain a stable asset with a committed tenant. However, the supply of suitable properties has not kept pace with demand, which has created a highly competitive market. For companies, this means it’s an opportune time to explore sale and leaseback options, as the demand from investors is high, potentially leading to favorable terms. Q: Are there any special considerations during the negotiation process? Marcel Arzner: Every aspect of the deal is negotiable, from the sale price to the lease terms. However, it’s essential to approach these negotiations with a clear understanding of market norms. While the current market environment might tempt companies to seek lower initial rents, it’s crucial to strike a balance that ensures both parties are satisfied with the long-term arrangement. At Qore, we guide our clients through these negotiations, ensuring that the agreements are fair and sustainable. Q: What role does professional guidance play in a successful Sale & Leaseback transaction? Oliver Spring: Professional guidance is vital. A successful sale and leaseback transaction requires more than just knowledge of the real estate market—it also demands an understanding of the financial implications and future business needs. At Qore Real Estate, we combine market expertise with a deep understanding of our clients’ businesses to create strategies that deliver real value. Our local market knowledge and experience in structuring deals ensure that our clients receive the best possible outcomes. Conclusion: Is Sale & Leaseback Right for Your Business? Sale and leaseback is more than just a financial transaction; it’s a strategic move that can significantly impact a company’s financial health and operational flexibility. For mid-sized businesses looking to unlock capital, navigate economic challenges, or invest in growth opportunities, sale and leaseback could be the key. With the right guidance and a tailored approach, this model can provide the liquidity and stability needed to thrive in today’s competitive market. At Qore Real Estate, we are dedicated to helping our clients achieve their financial goals through fair, transparent, and client-focused solutions. If you’re considering a sale and leaseback transaction, our team of experts is here to guide you every step of the way.

Property Upgrade: How we can add additional Value by advising on Sustainability in a Sale & Leaseback.

Property Upgrade in a Sale & Leaseback Transaction

Transforming your Property and making it ready for a Sustainable Future.

In a Sale & Leaseback transaction, upgrading your property is more than just an investment—it’s a strategic move towards a sustainable future. Our expert team works with you to transform your property, ensuring it meets the highest standards of efficiency, sustainability, and modernity. Whether it’s energy-efficient systems, eco-friendly materials, or smart building technologies, we implement upgrades that not only enhance the value of your property but also align it with future environmental goals.

With our comprehensive approach, your property isn’t just prepared for today’s market—it’s equipped to thrive in tomorrow’s. Let us help you secure a sustainable and profitable future with our tailored property upgrade solutions.